|

|

Study, work or travel in the UK. British

culture and life.

|

|

||

|

|

|

|

||

|

||||

|

|

|

|

||

|

||||

|

Life

/ Money

|

||||

|

Manage your money in the UK

|

||||

A bank or building society or post office offer financial services to customers through their branches, and may also offer internet banking or telephone banking. A branch is identified by a 6-digit number called a sort code.

Ways of transferring money from abroad to a UK account include electronic

transfer, a banker's draft and travellers' cheques. You can

change foreign currency into UK currency (pounds Sterling) at a bureau

de change or at a foreign exchange counter in a bank. The number

of pounds you receive depends on the exchange rate which is offered,

and you may also have to pay a charge known as commission.

The most common type of bank account used to manage your money in the UK is

known as a current account (American English: checking account). The

amount in your account is called the balance. If you have money in your

account you are in credit; if you have withdrawn more money than you

have, your account is overdrawn and you may agree to borrow money by

arranging an overdraft from your bank manager.

When you put money into your account you make a deposit; you may need to complete a form known as a paying-in slip.

When you take money out of your account you make a withdrawal. You can withdraw bank notes at a cash machine (also called a cashpoint or an ATM) using a cashpoint card by entering your personal identification number (PIN). You can also take out cash by completing a form called a withdrawal slip and giving this to a cashier in a branch of your bank.

Regular bills can be paid directly from your current account by arranging direct debits or standing orders.

You can also pay for many things by writing a cheque (American english: check); you may be asked to show your cheque guarantee card. After a cheque has been given to a bank, it will take several days before it has cleared (in other words, before the money is put in your account); if the person who wrote the cheque does not have enough money to pay, the cheque bounces. You can also use a debit card, which pays money directly from your account and is accepted by most shops.

Another method of paying is by using a credit card (such as Visa or Mastercard); in this case, the money is not paid immediately; you can borrow money up to your credit limit, but you will have to pay interest. You can see details about transactions in your account in a monthly statement sent by post from your bank or in a simpler mini-statement obtained from a cash machine.

Money can also be invested in a deposit account (sometimes known as a savings account), which pays a higher interest rate but offers slower access to your money and does not provide other banking services.

If you are only in the UK for less than 6 months, you may find it easier to

keep your money in an account in your home country (using travellers' cheques,

bank transfers, credit cards and cash machines to access your money). If you

are staying in the UK for more than 6 months, it may be useful to open a UK

bank account.

Advantages of having a UK current (checking) account:

Advantages of having a UK deposit (savings) account:

One idea is to transfer all the money you need for your stay when you open

your account. It is cheaper to make one transfer instead of many smaller transfers.

Another advantage is that you will not have to worry about the risk that during

your stay there is a sharp fall in the value of your country's currency or a

sharp rise in the value of the British pound. You will not benefit if your currency

strengthens or the pound falls, but you can be confident that you will have

enough money to be able to stay in the UK as long as you planned. Put most of

the money in a deposit account, earning interest. Each month, transfer enough

money from your deposit account to pay for all your living expenses, being careful

not to keep enough money there to prevent your account's balance becoming negative

(otherwise you will have to pay overdraft charges).

Back to top

Who can you ask for advice?

Your school may have a welfare officer who can suggest which local banks are

most helpful to international students, and what documents they require to open

an account. You should ask your classmates or friends about their own experiences.

If you are studying at a university, there may be a financial adviser who could

give you free advice about loans, bursaries, budgeting, benefits or taxes. This

person may be a member of NASMA (the National Association of Student Money Advisers)

What are the names of the UK banks?

UK banks include the following:

NatWest - http://www.natwest.com

Royal Bank of Scotland – http://www.royalbankscot.co.uk

HSBC – http://www.hsbc.co.uk

Barclays – http://www.barclays.com

Lloyds TSB - http://www.lloydstsbgroup.co.uk

Halifax – http://www.halifax.co.uk

Bank of Scotland - http://www.bankofscotland.co.uk

Abbey National – http://www.abbey.com

Cooperative Bank - http://www.co-operativebank.co.uk

How quickly can I open an account?

For security reasons after the terrorist actions of September 11th 2001, it

is unlikely that you will be allowed to open an account in the UK before you

arrive. After you have arrived, it may take a short time before you have collected

the necessary documents and visited the bank, and it might take a couple of

weeks before the account is ready to be used and before any transfer of money

from your country has been completed. In total, after arriving in the UK it

might take a month before your account is ready (if you are allowed to open

an account). If you need to pay for a course or accommodation soon after you

have arrived in the UK, ask for advice about the different ways of paying.

Will the bank allow you to open an account?

If you are an international student you may find the process of opening a bank

account more difficult than you expect. This is because there are strict laws

in the UK which are designed to prevent money laundering (hiding money obtained

from drugs or other illegal activities) or terrorist activity. In particular,

you need to prove both who you are and where you are living. You should read

the "opening an account" section below carefully.

What types of accounts should you consider?

(1) Current account

Bank staff will often encourage you to open a current accounts which charges

a monthly fee and provides extra services. Only open such an account if you

really need these services. There is usually a cheaper basic current account

which is available as an alternative. Before opening a current account, check

the fees which may affect you, for example if there are any charges for withdrawing

money from a cash machine, or how much it will cost if the balance in your account

becomes negative (overdraft charges).

(2) Branch-based deposit account

Branch-based deposit accounts offer higher interest rates than current accounts

(because you have fewer services and less access to your money).

(3) Postal or telephone account

Postal or telephone accounts offer higher interest rates than branch-based deposit

accounts (because you cannot use the services in the bank's branch). You will

have to write or telephone to withdraw money from these accounts.

(4) Internet account

Internet accounts often offer the highest interest rates (because they are much

cheaper for the bank to run). It may also be easier to keep track of this account

when you are not in the UK. Some of these accounts allow you to withdraw money

using a cash machine, while others will only allow money to be transferred to

a bank's current account (this may take several days). Although they often have

different names, the internet accounts are usually run by a major bank or insurance

company (for example, Egg is run by Prudential Insurance, Cahoot by Abbey National,

IF by Halifax).

How can you compare the interest rates?

You can compare the interest rates at different banks using the MoneyExtra website:

Current accounts: http://www.moneyextra.com/compare/current

Deposit accounts: http://www.moneyextra.com/compare/deposits

Make sure that you understand which services are offered for the accounts which

are shown, so that you can compare them properly.

Remember that interest rates can change quickly, and check that the interest

on your account remains competitive after you have opened it.

Other things to consider when choosing a bank branch for a current account

Does the bank have a branch close to your home and close to your school or workplace?

When is the bank open? Many branches are open from 9am to 4:30pm from Monday

to Friday; some branches open on Saturday mornings

Can you use your local branch, or are you only allowed to deal with a particular

branch, on the telephone or through the internet?

Can you use the cash machines of other banks?

Does the bank provide foreign exchange or international money transfer, and

if so what are the charges?

Does the bank have a special student adviser (most common in branches near a

university)?

Will you be able to obtain an overdraft if you need to borrow money for some

reason; if so, what are the charges?

To open a bank account you will need first to collect some documents to prove who you are:

Identity

To prove who you are, you need an official document which includes a photograph.

Your passport is probably the best example.

UK address

You need to prove where you live in the UK. There are strict laws which

make it difficult to hide money which has been obtained from crime or terrorism,

but which also make it harder for foreign students to open bank accounts in

the UK. Check carefully with a bank exactly what it requires you to do to open

an account - this will save you a lot of time. Many international students do

not have any of the usual documents which are accepted - for example: a UK driving

licence, or a utility bill (for gas, water, electricity or telephone) in your

name.

The best way to overcome this problem is usually to ask your school if it has

an arrangement with a local bank branch, and to apply to this branch. You will

need to ask your school for a letter confirming that you are studying there

and stating your address (this letter should be written on the school's official

notepaper).

Most banks will accept some alternative proof of address, but the policy may

vary from one branch to another. A survey of some bank branches in April 2004

revealed that each one had different requirements:

- one required a statement from your bank in your home country (written in English),

showing your bank balance over a period of at least 3 months, and sent by the

bank directly to your address in the UK

- one stated that an NHS medical card would be accepted (you can receive one

of these after you have registered with a British doctor; see: Personal/Health)

- one said that a letter from your landlord would be accepted, provided that

he/she has an account at the same bank (the letter needs to confirm the landlord's

bank sort code and account number, and must state where you are living)

- one said that an offshore account could be opened, requiring proof of your

foreign address and confirmation that you are not a UK resident

It may be helpful if you take with you some additional evidence of where you

live. Your accommodation contract (assuming that it is a typed, official document)

and your National Health Service medical card may be worth taking with you if

you have them.

Home country address

To prove your address in your home country, take a document with your address.

If possible, the address should be written using the Western alphabet so that

an English person can read it. Examples of suitable documents are:

- A letter of acceptance from your school, if this was sent to your permanent

address in your home country

- A statement from your bank in your home country

- Your passport (if your home address is shown)

Student status

If you are studying at a UK university for over a year, you may be offered a

student account (these may be offered only between August and November, because

the academic year starts in September in the UK). A student account may offer

you lower charges and there may be some special offers. To prove you are a student,

take a letter from your school which states the dates of your course.

Your credit record

If possible, ask your bank for a reference letter from your bank in your home

country, written in English.

Sources of income

The bank may want to know how you are financing your stay in the UK (for example,

from your own savings, from your family or from some other sponsor or scholarship).

The processes required to open a current account in a bank branch are as follows:

Be careful to try to avoid some problems that sometimes occur when foreigners try to open an account, for example:

- First name and family name the wrong way round

- Cards and chequebook sent to the address abroad, instead of your UK address

or the bank branch

- Note that it takes time (usually between 1 and 2 weeks) before the account

becomes active

- The bank cannot open an account because you have no proof of your address

It is common for a card to allow you to withdraw £250 per day.

If the card is stolen and used by the thief, you may have to pay the first £50

lost, or the full amount if you have lost the card and a note of your PIN at

the same time

Statements will probably be sent to you monthly; you can also find your balance

using a cashpoint machine.

UKCISA produce a guidance note for students on "Opening and running a bank

account in the UK". You can access this from the page: http://www.ukcisa.org.uk/student/information_sheets.php.

Back to top

A cheque guarantee card guarantees payment up to the limit shown on

the card (eg £50)

Some people will not accept a cheque without seeing a cheque guarantee card

at the same time

If the cheque is for more than the guaranteed amount, you may be asked to write

several cheques for smaller amounts, or may be asked to provide proof of your

identity and your home address

Even without a cheque guarantee card, cheques can be used for postal payments

A cashpoint card can be used in cash machines ("automatic telling

machines", "ATMs")

Check if you can use another bank’s machine to take out money, and if you

will be charged for this

A debit card (eg Switch, Delta or Solo) pays directly from your account

(by "electronic fund transfer") and is accepted by most shops.

A servicecard can be used as a cheque guarantee card, cashpoint card

and debit card

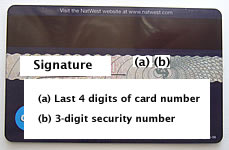

Front of debit card |

Back of debit card |

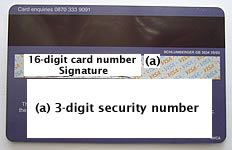

Front of credit card |

Back of credit card |

Banker’s draft

A banker’s draft is a document drawn up by the bank in your home country

You can carry this with you to the UK, or ask for them to send it to your UK

address

You present the draft to your bank in the UK

If the draft is in Sterling, it will be credited to your account quickly and

there will not be a handling charge

Cheques

A slow method; cheques may take several weeks to clear

Credit card

Withdrawing money from your credit card can be expensive because of high

interest charges

Traveller’s cheques

Keep a record of the numbers of traveller’s cheques and credit cards in

case of loss or theft

Other international money transfer services

International money transfer services are also offered by MoneyGram or Western

Union.

Compared to a bank transfer this can be a more expensive and less secure way

to move money, but it is useful if the sender or receiver doesn't have a local

bank account.

To make a transfer, in one country the sender pays money to a local MoneyGram

or Western Union agent, shows identification, and says who will receive the

money and where it will be collected. The sender is given a reference number

and must tell this to the person who will receive the money. The receiver goes

to the agreed location, shows identification and quotes the reference number,

and can then receive the money. There are limits on how much money can be transferred

in this way. It is important to make sure that you know what identification

is required and that you keep your reference number private.

Exchange rates

To find the current value of 1 pound in units of your currency, click on the following link:

[ in the three boxes, choose 1, "England (UK) Pounds" (or "UK Pounds"), and your currency; then click on the "Go!" button ]

![]() XE.com Personal Currency Assistant

XE.com Personal Currency Assistant

Make sure that payment by cheque is acceptable

Many shops will not accept cheques for small amounts (for example, under

10 pounds), because the shop has to pay a fixed charge to its bank for each

cheque.

Many shops will not accept cheques unless you can show them a "cheque guarantee

card" (you should not need this card if you are paying by post, or if the person

you are paying knows you – sometimes banks do not issue cheque guarantee cards

to international students)

Don’t write a cheque unless you are sure you have enough money in your account

(otherwise the cheque may be returned to you by your bank, and you may have

to pay a charge – in this case, we say the cheque has "bounced")

Write the name of the person or company you are paying (the ‘payee’) on

the first line (top left)

Make sure that the name is clear and cannot be changed easily

For example, for a telephone bill you might write "British Telecommunications

plc" instead of "BT" (if the cheque is stolen, this could easily be changed

to look like somebody’s name)

If you are paying a bill, it usually tells you the full name to write (you may

need to look on the back of the bill)

Write the amount being paid in words on the second line (continue on the

third line, if necessary)

Write the number of pounds in words, followed by the number of pence using

two numbers (eg 05 for 5 pence)

If the amount is an exact number of pounds write the word "only" instead of

the number of pence

For example: £185.08 should be written "One hundred and eighty five pounds 08"

For example: £12.50 should be written "Twelve pounds 50"

For example: £2,500.00 should be written "Two thousand five hundred pounds only"

If sending the cheque by post, the words "account payee" should be be used

Normally you don’t need to write these words, as they will be printed on

the cheque already

These words (or "a/c payee") should be written between the two vertical

lines in the middle of the cheque

Enter the date (top right)

In the UK the order is always day-month-year (in the US, for example, the

order is month-day-year)

For example, you could write "1 February 2000" or "1/2/2000"

Today’s date should normally be used, assuming you have enough money in your

account

If you want to enter a future date (to "post date" the cheque), tell the person

being paid

Write the amount being paid in numbers in the box (centre right)

The pound sign (£) is normally already written on the cheque

Use a comma to indicate thousands (not a dot, as used by some Europeans)

Use two parallel lines to fill the space between the number of pounds and the

number of pence

(If you leave spaces, it may be possible for someone to change the words and

numbers on the cheque)

Use two numbers for the pence, and 00 if it is an exact number of pounds

For example "185=08","12=50","2,500=00"

Sign the cheque (bottom right)

Use the same signature as on your cheque guarantee card

If you are paying a regular bill, write your address or customer number on the back of the cheque

For your information, copy the details on the cheque ‘stub’ (left)

If you give a cheque to someone directly, he/she may want to see your "cheque

guarantee card"

The person receiving the cheque may want to write down the card number,

and check that the signature on the cheque is the same as the one on the card

The bank will pay up to the amount shown on the back (often £50), even if you

don’t have money in your account

If your bank has not issued you with this card, sometimes the person may not

accept payment by cheque

Some machines have a deposit slot, allowing you to put money into your account

even when the bank is closed.

Other ways of obtaining cash

Note that some supermarkets may offer you a "cashback" when you use

your card to pay for your shopping. This means that the cashier gives you the

amount of money you request, and this amount is taken from your account in addition

to the cost of your shopping.

You can write a cheque as normal but put "Cash" on the top line instead

of a person or a company's name, and take this to a branch of your bank.

Travellers' cheques

Keep a record of the numbers of travellers' cheques and credit cards in case

of loss or theft.

Documents

Keep your bank statements, water/gas/electricity/telephone bills, rental agreements,

as well as any correspondence with your school, bank or immigration authorities

(keep a copy of any application forms you send). For example, these documents

may help you to open a bank account or to apply for an extension to stay as

a student in the UK.

Budget

Budget carefully; keep a detailed record of your expenditure and income.

Financial difficulty

- UKCISA also produce a range of helpful guidance notes which you can access

from the page: http://www.ukcisa.org.uk/student/information_sheets.php.

There is a guidance note on "Financial hardship". Some people may

be allowed to claim money from the government (welfare benefits). See the guidance

note on "Welfare benefits and international students".

- If you think you may need to borrow money from the bank, talk to your bank

manager and school as soon as possible.

- If you are allowed to work in the UK, you may consider looking for a job (see:

Work/Search).

- You may need to move to cheaper accommodation or to a cheaper part of the

UK (for information about looking for a room, see: Life/Accommodation/Guide).

- If your school fees are too high for you, you may also need to consider moving

to a cheaper school. For information about looking for schools, see Course.

Safety

To avoid having money stolen from you:

- Keep your personal number private. Do not write it down, and do not tell

anyone. If you lose your number and card together, you will not be able to recover

any money that is stolen from your account. When you enter your personal number,

stand in front of the machine and make sure that nobody can see the numbers

you are typing. If someone is standing close behind you, ask the person to move.

It may be safer to use machines inside bank branches and to avoid machines in

busy areas (for example in stations and airports).

- Do not let anyone distract you before you have taken your card from the machine

(for example, by talking to you, touching your shoulder, or dropping money);

this may be done by a thief working together with a second person, who may take

the card from the machine when it comes out. Do not let a stranger help you

to use the machine, even if the card is kept.

- Only carry small amounts of cash with you; use cards or cheques to pay for

larger bills. If you think your card may have been lost or stolen, report this

immediately both to your card company and to the police; if a bank is open nearby,

it may be able to give you advice.

- Check the daily withdrawal limit for your card. If it is high, make sure

that your bank or insurance company will pay back any money stolen if you lose

your card

|

|

|